According to recent studies, 2024 was the hottest year on record. Temperatures rose by over 1.55°C above pre-industrial levels last year and could rise to 3°C above pre-industrial levels by the end of the century.

Global warming has increased the frequency and intensity of extreme weather events such as heat waves, wildfires, hurricanes, and floods, reducing economic productivity and damaging business assets. Climate mitigation remains a priority for investors, but investing in climate adaptation and resilience (Climate A&R) has now moved into sharper focus.

Financing for Climate A&R projects stands at around $76 billion a year, with public actors accounting for most of it. According to the 2024 UN Adaptation Gap Report, the countries of the Global South will need Climate A&R investments of between $215 billion and $387 billion a year from 2025 to 2030. Accounting for the developed countries, total Climate A&R expenditure must rise globally to between $0.5 trillion and $1.3 trillion a year by 2030.

The public sector is expected to account for most of the funding, but the urgent need for Climate A&R solutions will create new value pools across value chains, presenting a growing investment opportunity. Notwithstanding this trend, Climate A&R is a relatively unexplored space for most private investors. Its very nature poses challenges in defining the universe of Climate A&R related solutions providers and identifying investable sectors and companies.

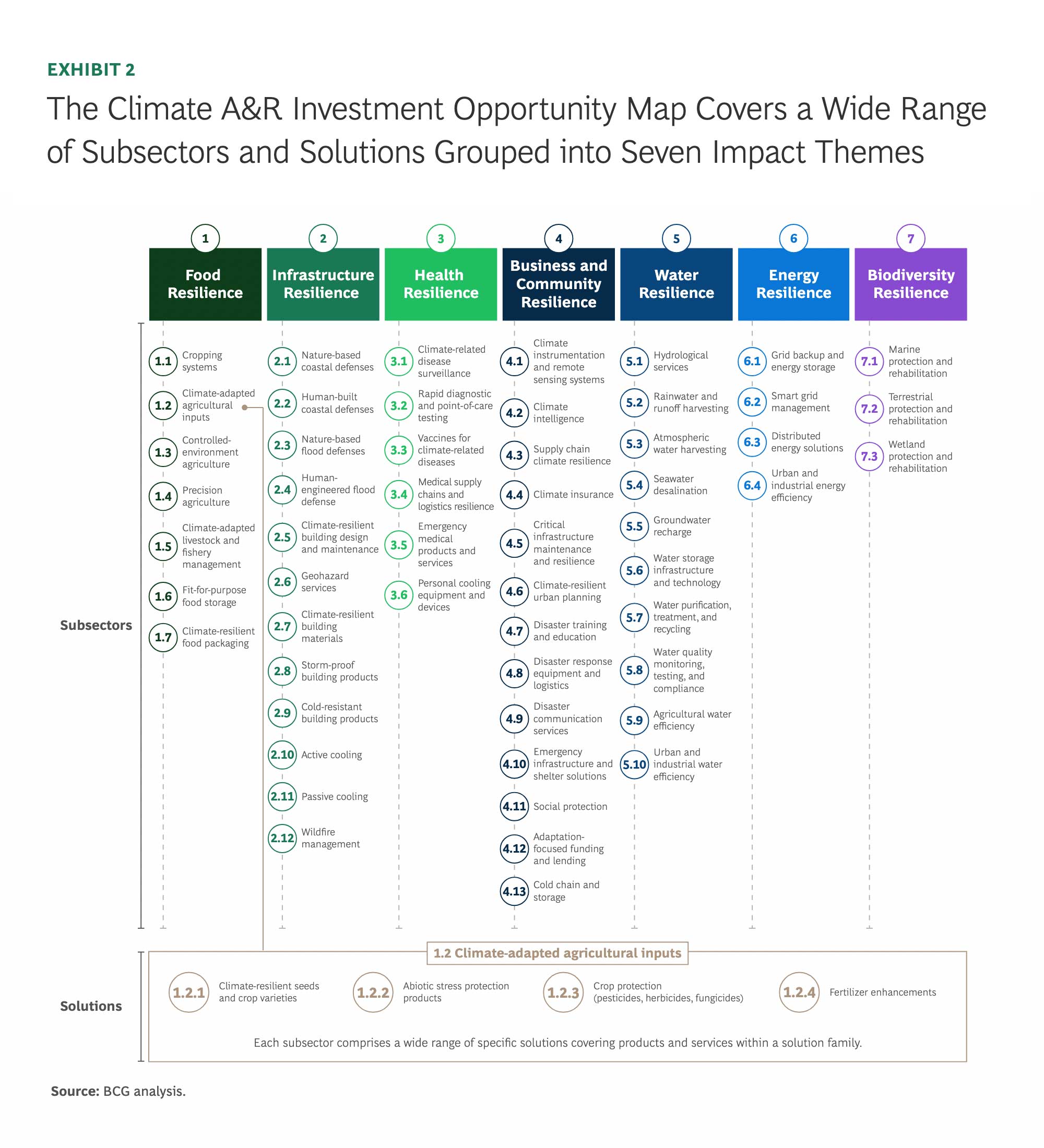

To shine a light on the way forward, BCG developed the Climate A&R Investment Opportunity Map, which lays out the landscape for private investors. To assess the potential of private equity strategies, such as growth, buyout, and venture capital, the relative commercial attractiveness of these opportunities was analyzed with the help of current and forward-looking signals. Investors with other foci, such as impact investing, infrastructure, credit, and public markets, may also find this analysis useful.

A broad range of investment opportunities in this area are ripe for investment. Multiple subsectors have multi-billion-dollar markets, double-digit growth rates, attractive margins, and a pool of private companies. Our study shows that Climate A&R companies tend towards two dichotomies: early stage pure-play companies or large diversified players. That will allow private investors to use a range of investment strategies. In fact, this report dives into six investable Climate A&R-related subsectors, projecting their growth, segmenting the markets, and identifying investment trends in each of them.

Climate A&R presents an investment avenue for financial returns and sustainable impact. Private equity investors have a critical role to play in shaping and advancing this frontier. By drawing on their expertise in value creation, scaling businesses, and guiding companies to maturity, private equity investors can help build a more resilient world while securing a stake in one of the defining markets of the future.

Download the report here.

Access the explainer video here.

“With global warming accelerating and extreme weather events becoming more severe, it is inevitable that climate adaptation and resilience (A&R) solutions would have to become mainstream. This means that significant amounts of public and private capital are required to close the investment gap needed to meet the growing global demand for such solutions. We hope the investable opportunities highlighted in this report offer private equity investors clear pathways to tap into a rapidly expanding market – while contributing to a more resilient world for generations to come.”

— Franziska Zimmermann, Managing Director, Sustainability, Temasek