In an era defined by rapid technological disruption and global sustainability imperatives, sovereign wealth funds (SWFs) are undergoing a profound transformation. No longer passive stewards of capital, they emerge as proactive architects of change — shaping markets, driving innovation, and redefining what it means to be a responsible investor.

SWFs now stand at the intersection of investment, technology, and impact. With tens of trillions of dollars under management and long-term mandates, they are uniquely positioned to lead impact investing in the new era of AI digital economy.

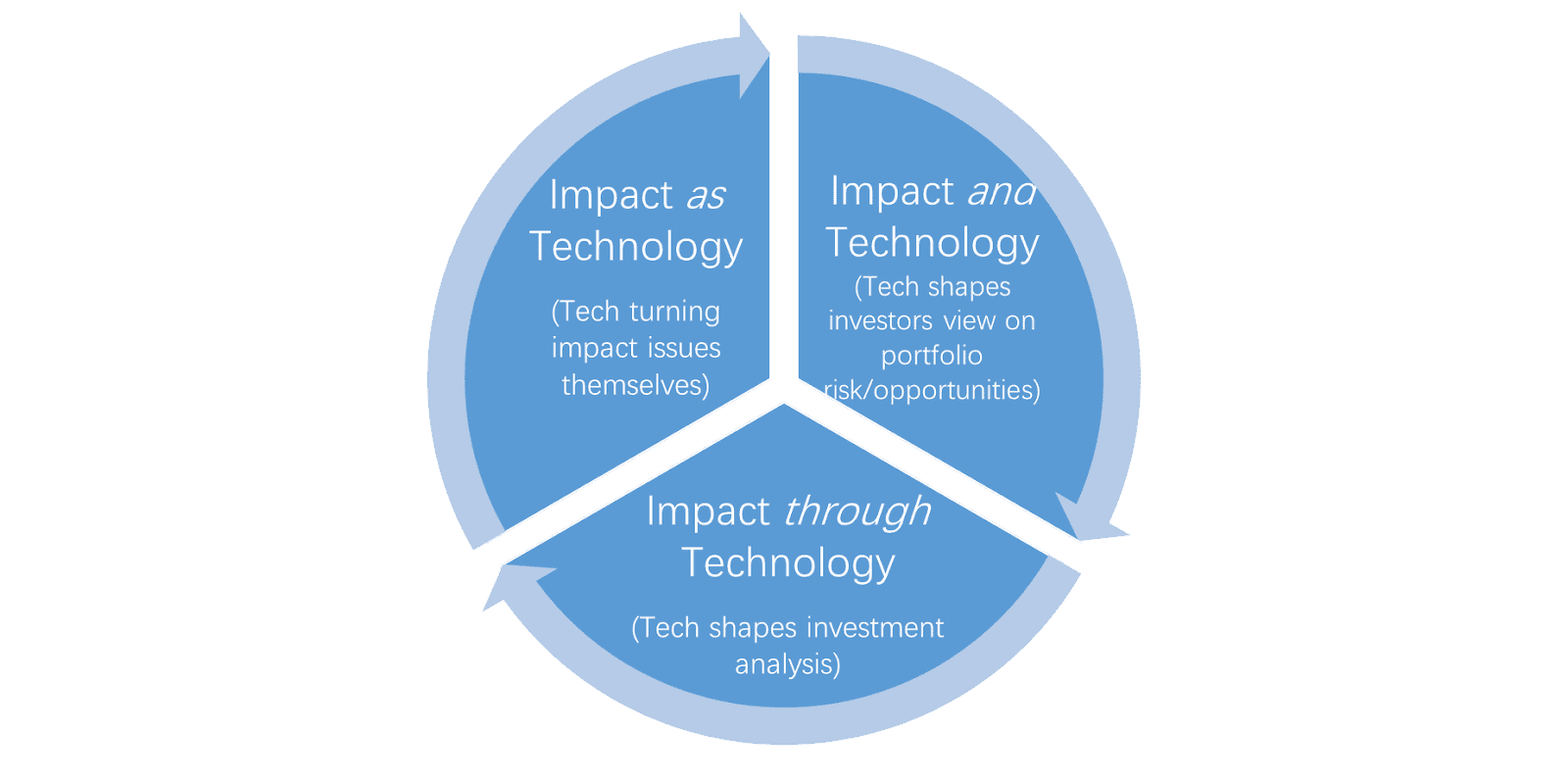

The convergence of artificial intelligence (AI), big data, blockchain, cloud computing, and many more digital technologies is fundamentally reshaping how SWFs invest and operate. There are three perspectives for SWF investors regarding the relationship between technology and impact (see the Figure below):

- Impact as Technology: New technologies, such as AI, constitute impact issues themselves

- Impact and Technology: Tech revolution changes investors’ evaluation of risks and opportunities in their portfolios

- Impact through Technology: Advanced technologies enable investors to be more sophisticated and effective in impact investing

First, Impact as Technology.

SWFs are positioning themselves as impact investors by actively investing in AI technology and data infrastructure, recognizing the transformative potential of these assets to drive long-term economic growth and societal development. A prime example is Saudi Arabia’s Public Investment Fund (PIF). In late 2024, PIF partnered with Google Cloud to establish an advanced AI hub in Saudi Arabia, signaling a strategic move to build domestic technological capacity while attracting global tech talent and investment.

By backing such ventures, PIF is fostering a new ecosystem where AI research, cloud computing, and data governance converge to support smart cities, healthcare, education, and sustainable infrastructure — sectors critical to its future economy. The partnership’s societal impact is equally significant, as it plans to feature joint research on Arabic language models as well as Saudi-specific AI applications.

Second, Impact and Technology.

One of the most compelling examples of how sovereign wealth funds are adapting to the AI era for their portfolio management is the world’s largest SWF, NBIM of Norway. With nearly $2 trillion in assets under management and holds 1.5% of all listed companies in the world, NBIM has long been using its shareholder voting power to push for stronger climate disclosures, board diversity, and corporate accountability.

In recent years, NBIM has voted against management at major tech firms like Alphabet (Google), Amazon, and Meta (Facebook) when they failed to meet its expectations. Furthermore, driven by the latest AI revolution, NBIM in 2023 and 2024 took a significant step forward by developing new AI-related voting guidelines.

The new guideline emphasizes transparency, explainability, and accountability in AI systems, expecting companies to clearly disclose how AI is designed, trained, and tested, and to ensure that all stakeholders can understand and assess the impacts of these technologies. Meanwhile, NBIM has actively engaged with peer institutions and global organizations to shape emerging standards for AI governance.

Third, Impact through Technology.

Recent AI innovations have opened new possibilities for investors to integrate sustainability criteria into their investment process and portfolio construction. Increasingly, the market recognized that “traditional” ESG data does not give investors a comprehensive perspective on companies’ ESG performance. (For example, most ESG data is self-reported and hence likely to be biased.)

Now, new technologies allow investors to supplement their analysis with unstructured data (for example, sentiment analysis based on companies’ disclosure) and extra-financial data (such as news items and social media). In their recent annual reports, many SWFs repeatedly point to an overarching goal of using data to make better, more informed investment decisions.

For example, the investment teams of GIC, a major SWF of Singapore, use AI tools—such as their bespoke ChatGPT-like bot, ChatGIC—for summarization and “opinion mining” of annual reports, management call transcripts, and alternative data, enabling them to quickly distill key insights and focus on material issues amid information overloads. They leverage AI and quantitative techniques to assess complex risks of new investment opportunities, including those related to climate and sustainability.

In summary, leading SWFs are increasingly deploying AI-powered tools across the entire investment lifecycle—from idea generation and due diligence to post-investment monitoring and engagement. These tools are not only enhancing efficiency but also enabling deeper, more nuanced insights that support long-term, sustainable value creation. As a result, SWFs are transforming themselves into more sophisticated, impact-driven investors.

Standing at the intersection of investment, technology and impact, SWFs will increasingly lead investments in the AI economy, uniting to vote on corporate AI agenda, adopting AI to monitor the conduct of portfolio companies, chiding the management of others, and rebalancing their portfolios to de-risk them for climate change and technological disruption. The future of investing is at an inflection point, and the SWF investors are becoming the guardians for our digital future.