Signature Impact Framework

The Signature Impact Framework allows companies and investors to conduct a rigorous but cost-effective assessment of the impact of a given business.

Why Another Impact Measurement Framework?

There is a myriad (250+) of models, tools, and techniques for measuring the impact of investments.

In this alphabet soup, companies and investors alike are overwhelmed by the complexity, the lack of generally accepted standards, and conflicts of interest, which often undermine the credibility of commercial proposals. As a result, they often—understandably—throw in the towel and rely on financial performance as the primary assessment tool. This is no longer viable in a world where sustainability is front and center in investment decision making.

Why Signature?

Every zebra has a unique stripes pattern. likewise, each enterprise can make – along with profit – a unique, distinctive contribution to societal welfare.

We call it Signature Impact.

The working assumption of our approach is that quantifying the full social impact of a business by considering all stakeholders is analytically challenging and prohibitively expensive, if even possible. Every business, however, can articulate its high-level social goal and purpose enshrined in its mission. SIF builds an impact assessment model to quantify the expected and achieved outcomes of the business exclusively within its purpose of choice.

We are Researchers

At the crossroad of academia and industry, we are a team of researchers with a focus on understanding, analyzing and modelling the fundamental drivers of impact.

We collect scientifically validated evidence across multiple SDGs and create databases products and solutions with practical applications for investors in need of better data so they can decide how to deploy capital in private markets while managing risk and impact performance.

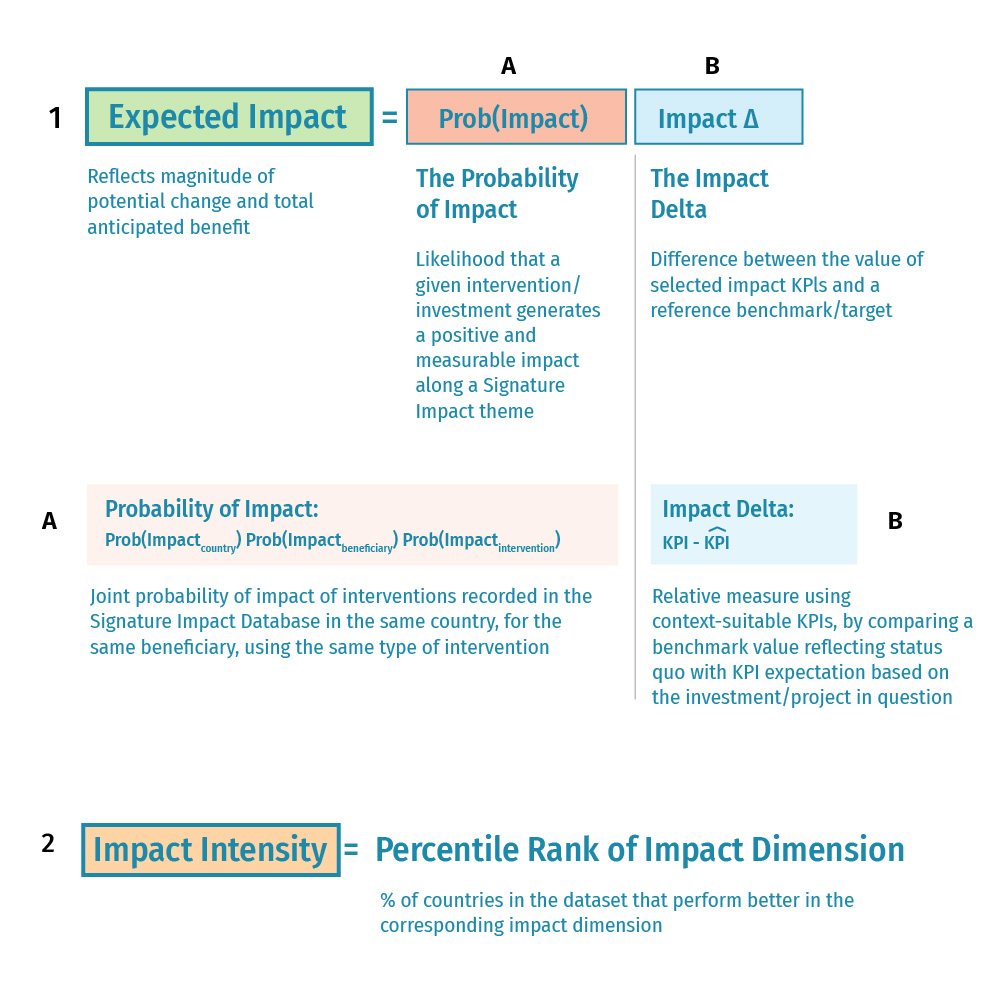

Seeking Impact Delta (∆)

When we assess the social impact of an investment, we ask what its contribution is relative to the status quo or to suitable benchmarks or targets. Impact quantification is thus not aimed at an absolute measure but a relative one, which we call the impact delta.

For example, the number of jobs created by a project is an absolute measure of impact, while the positive effect in terms of reducing the unemployment rate in a given community is a relative measure that takes initial conditions into account.

Similarly, an investment in renewable energy produces a given level of carbon emissions (absolute impact), but the impact delta of that same investment in terms of carbon avoidance will be greater or lesser depending on the prevailing carbon intensity (i.e., CO₂ emissions per megawatt) in the context where the investment takes place.

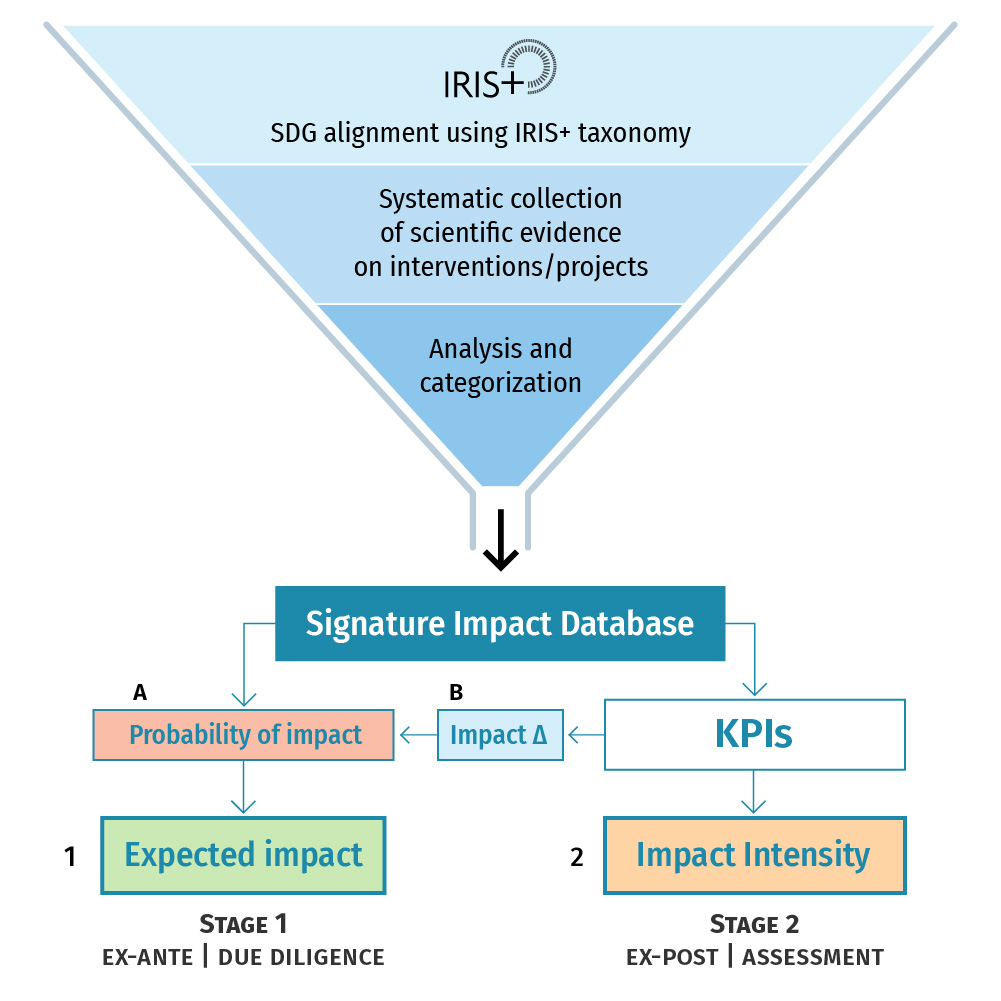

How it works?

Our Value Proposition

When deciding whether to commit capital to a project, an investor is naturally interested in understanding, with reasonable approximation, whether the investment will generate a positive social impact.

After funding the project, the investor also wants to regularly monitor both its financial performance and its social impact, as well as evaluate the total impact achieved by the end of the investment.

TIL has developed a proprietary model that enables the quantification of social impact throughout the entire investment cycle, from due diligence to exit.

Using scientific models and the best data and evidence available, SIF can de-noise and correct biases in the data to provide investors with access to robust and representative impact information.