Introduction

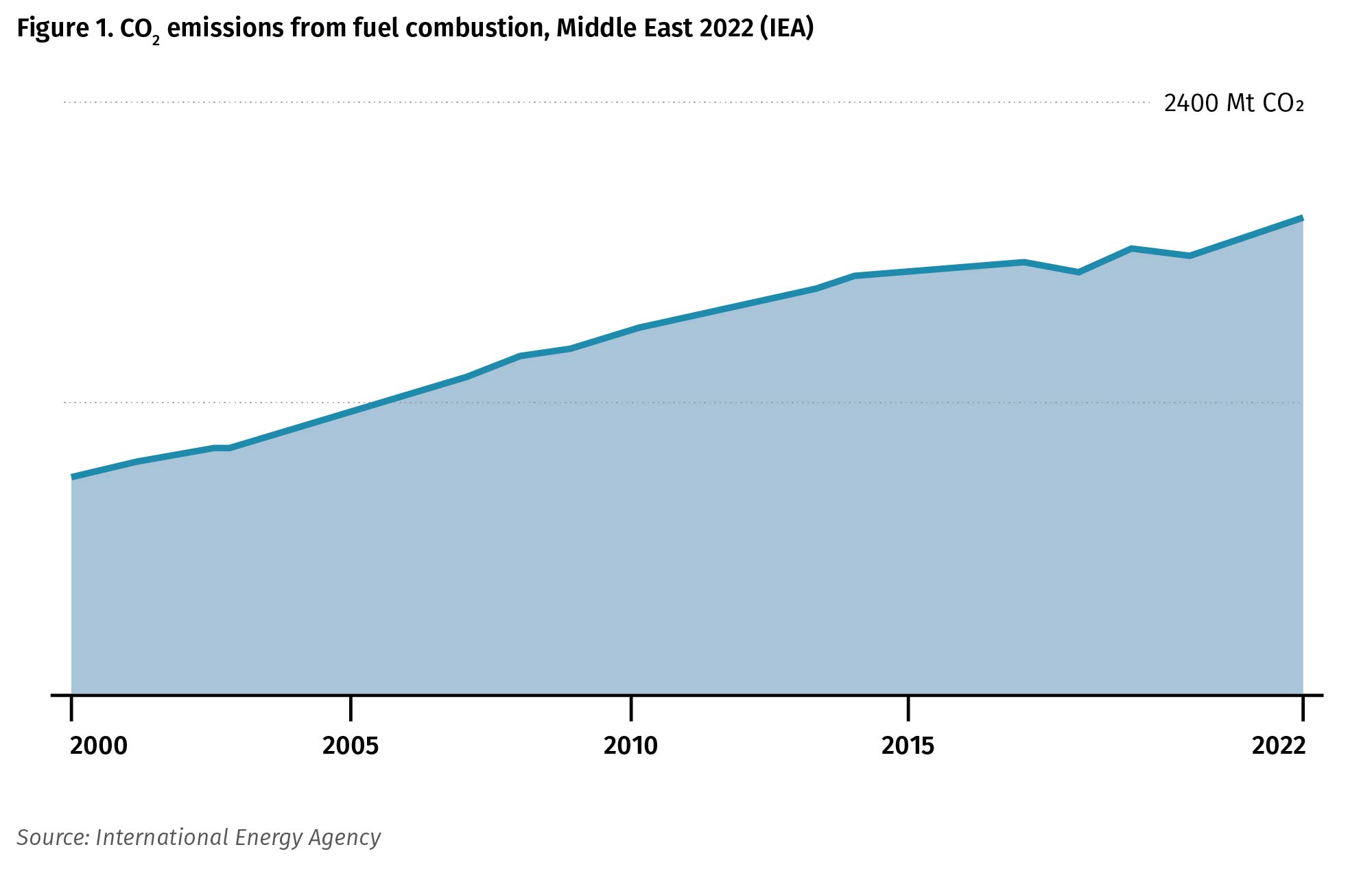

The Middle East and North Africa (MENA) region is highly vulnerable to the effects of climate change. Already the hottest and driest region on the planet, increasing temperatures and water scarcity could render some areas uninhabitable in the coming decades.

Countries and companies in the MENA region are increasingly committing to decarbonisation and sustainable development. Especially, the Gulf countries are striving to align their economic expansion, which is largely dependent on fossil fuel industries, with sustainable, low-carbon economy practices. Almost all Gulf countries have pledged to adhere to the emissions reduction objectives of the Paris Agreement and have made commitments towards carbon management. With their net-zero emissions commitments, the Gulf countries are exploring a variety of possible solutions. These include investing in low carbon engineered solutions like renewables, energy efficiency, hydrogen, and carbon capture and storage and carbon markets, which is gaining momentum.

The current developments include design and implementation of national regulatory frameworks, auctioning of voluntary carbon credits (VCM), economic linkages with African and south Asian countries, Article 6 readiness, reactive carbon pricing primarily in response to the EU’s Carbon Border Adjustment Mechanism (CBAM) leavy.

What are Carbon Markets?

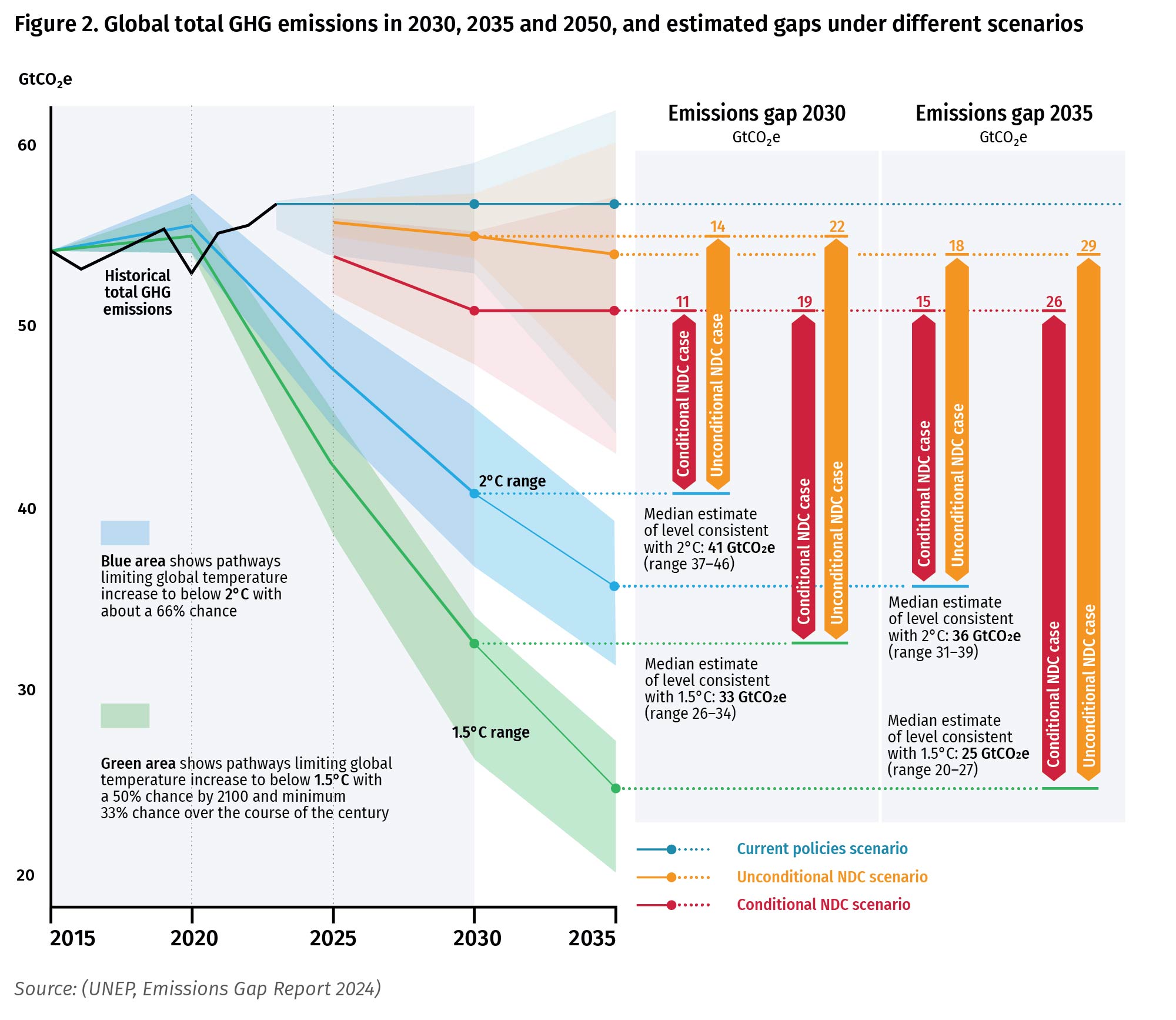

The Paris Agreement’s goal to limit global average temperature rise to 1.5°C is at risk. Climate action requires significant investment. Yet, according to the Intergovernmental Panel on Climate Change (IPCC), current financial flows are three to six times lower than needed by 2030, with some of the world’s poorest regions facing the biggest gaps.

Carbon markets can help bridge this gap by mobilizing new resources for emission reductions and sustainable development. Carbon pricing now covers 28 percent of global emissions, generating over US$100 billion in 2024. These funds are increasingly being used to support activities that benefit climate action and promote sustainable development, including initiatives that advance socio-economic opportunity and support communities.

Carbon markets are systems where carbon credits are traded. These credits represent a reduction or removal of greenhouse gases from the atmosphere. Governments, companies and even individuals can buy these credits to offset their emissions. Carbon credits are generated by project developers following approved methodologies overseen by standards bodies. Carbon credits work across three main markets:

- Voluntary Carbon Market: for organisations purchasing credits to offset emissions voluntarily.

- Compliance Market: for meeting legally binding carbon reduction targets like emissions trading systems (ETS) which use a cap-and-trade approach, where governments set an emissions cap and companies trade allowances.

- International Carbon Market (Article 6): for governments and companies trading credits under the Paris Agreement.

Overview Of Carbon Markets in the MENA Region

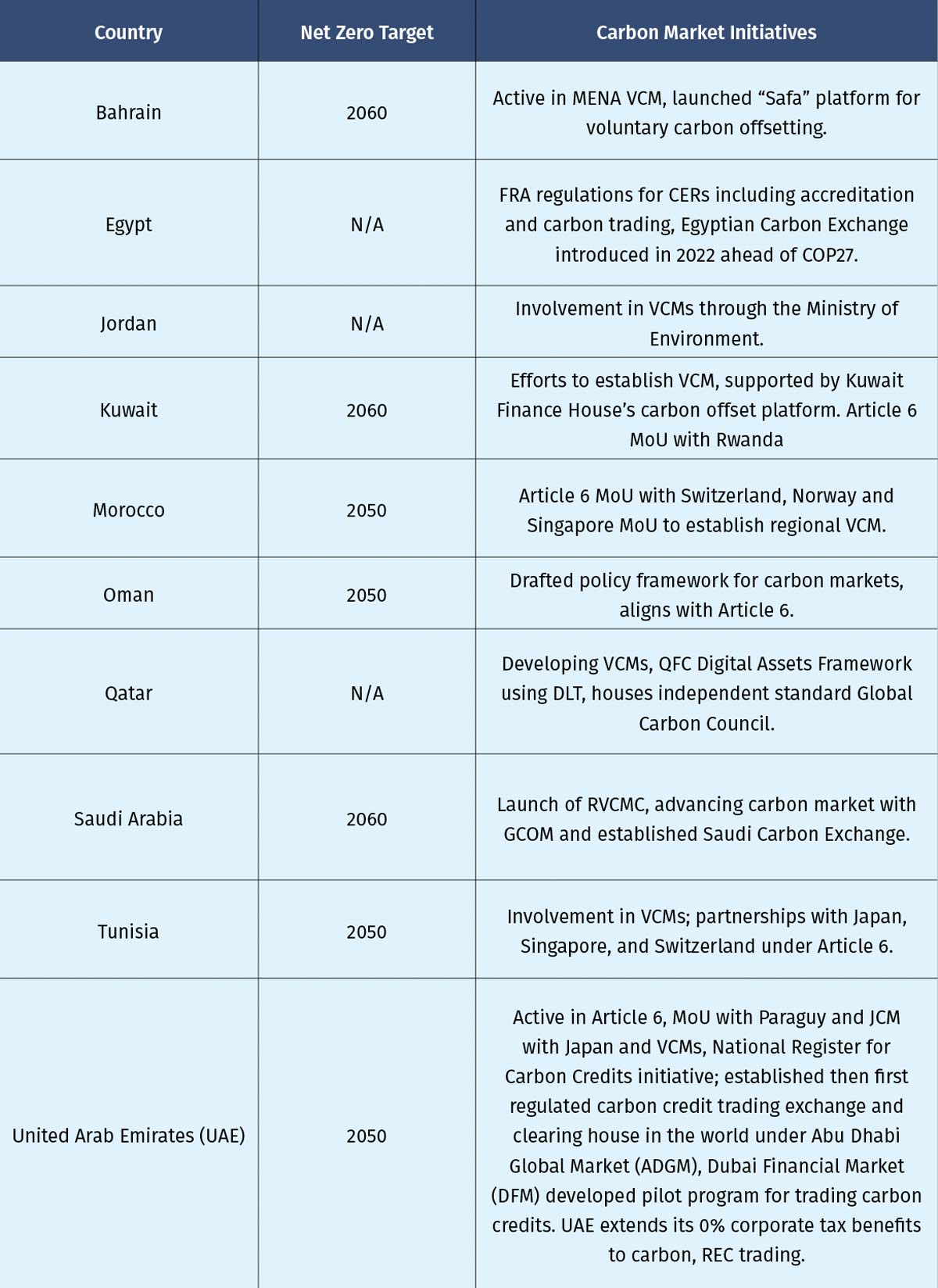

The MENA region has a significant role to play in global efforts to mitigate climate change. With both COP 27 (Egypt) and COP 28 (UAE) hosted in the region, several countries have explored implementing initiatives aimed to put a price on carbon, develop domestic and regional carbon markets and engage in international carbon market transactions. Government involvement has been matched by business interest from industrial and financial groups. The reasons vary across countries and include the achievement of nationally determined contributions (NDCs), compliance with the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) scheme for the international aviation sector, economic diversification, and attempts to assert leadership in energy and climate. This policy brief provides an overview of notable developments in key countries over the past twelve months. While some developments have been notable and should be encouraged, carbon pricing and carbon markets should be significantly scaled up as part of a broad policy package to harness their full potential and contribute to mobilise investment in emissions reductions and removals.

Carbon market initiatives are rapidly evolving across the MENA region, with the UAE leading the way. It has launched the region’s first regulated carbon credit trading exchange and clearing house via ADGM, while Dubai Financial Market (DFM) has initiated a pilot program for carbon credit trading. The UAE Carbon Alliance and Offset8 Capital’s regulated carbon credit fund focused on nature-based solutions further highlight the country’s leadership from private sector perceptive.

A major update is the UAE’s Cabinet Resolution No. 67 of 2024, which establishes the National Register for Carbon Credits. Under this law, carbon credits are now recognized as financial instruments, allowing entities to buy, sell, and use them for tax and compliance purposes and UAE introduced landmark climate legislation, Federal Decree Law No. (11) of 2024 on the Reduction of Climate Change Effects (the Climate Change Law), requiring all entities, including those in free zones, to measure, report, and plan for the reduction of their greenhouse gas (GHG) emissions. A key recent development is the UAE Ministry of Finance’s Ministerial Decision No. 229 of 2025, which now includes carbon credits and renewable energy certificates as qualifying environmental commodities under the 0% Free Zone corporate tax regime a major step in integrating carbon markets into the national financial and regulatory framework. This positions the UAE as a global hub for transparent and regulated carbon trading.

Saudi Arabia is advanced with its Greenhouse Gas Crediting and Offsetting Mechanism (GCOM) which is also the national designated authority for UNFCCC and the Regional Voluntary Carbon Market Company (RVCMC, now VCM company), backed by Public Investment Fund (PIF) conducted series of international VCM auctions, the first took place in October 2022, selling 1.4 million credits for undisclosed price, followed by second in Kenya in June 2023 which sold .2 million credits at price of $ 6.3 and third in during COP29 in Baku in November 2024, its first auction on its new exchange platform, selling over 2.5 million tonnes of carbon credits at a core basket clearing price of $ 10.30 per tonne and latest one with the Arab Federation of Capital Markets (AFCM) hosted a trader-led carbon demonstration auction” event was held in Tunisia on May 2025 no volume or price disclosed, which aims to scale Voluntary Carbon Markets in region

Egypt launched Africa’s first regulated Voluntary Carbon Market, enabling carbon certificate trading on its stock exchange, launched the Egyptian Exchange (EGX)’s voluntary carbon market aligning with global efforts to strengthen both voluntary and compliance markets.

Qatar is engaging in Article 6 discussions and hosts the Global Carbon Council in 2019 to issued voluntary carbon credits. Oman, Morocco, and Tunisia have introduced policies and regulations for carbon credit verification and certification, laying the groundwork for future market participation.

While regional engagement with Article 6 mechanisms is still developing unlike CBM era which had low participation, MENA countries are building capacity and aligning with global standards. The EU’s CBAM poses challenges for carbon-intensive exports and shipping, but carbon markets offer a strategic opportunity to mitigate these impacts and accelerate climate action.

In aviation, the United Nations CORSIA programme caps international flight emissions at 2020 levels. Airlines must buy carbon credits to offset any growth beyond that, driving global demand for high-quality offsets, especially from nature-based and clean energy projects. Within this cohort, most countries in the MENA region are looking at obligation and opportunities for compliance with the UN’s CORISA aviation offsetting scheme. In December last year, the UAE launched a new digital platform to facilitate domestic CORSIA implementation.

Article 6 of the Paris Agreement

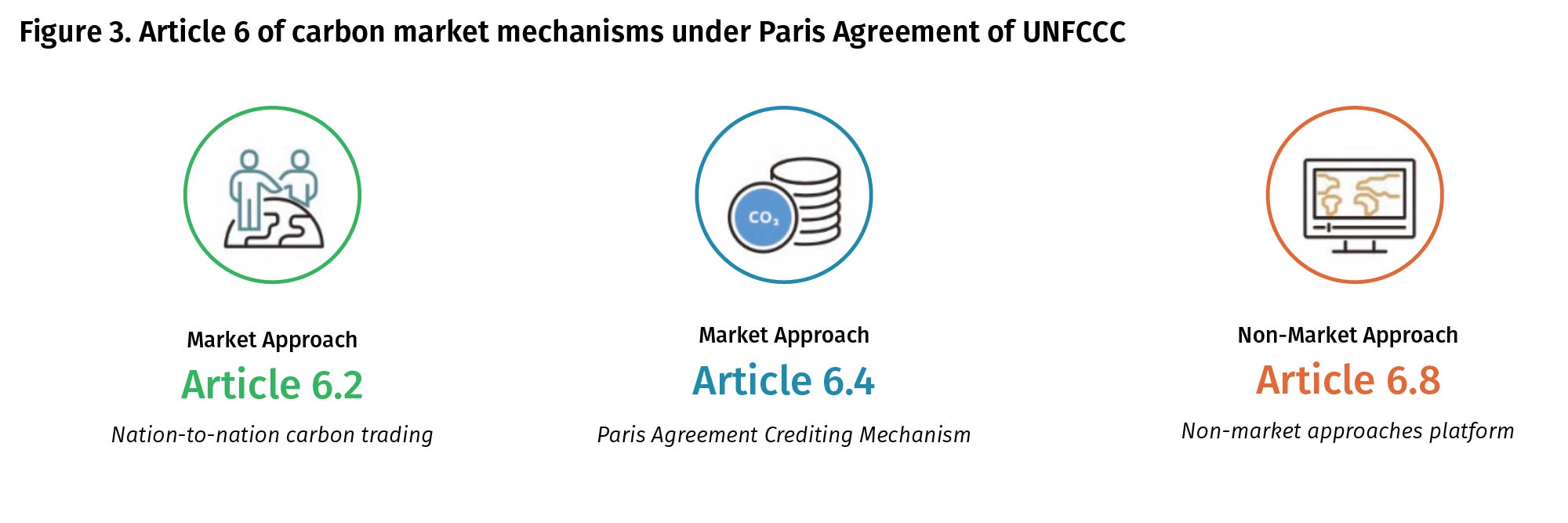

After nearly a decade of work, countries have agreed on the final building blocks that set out how carbon markets will operate under the Paris Agreement, making country-to-country trading and a carbon crediting mechanism fully operational.

The Paris Agreement’s Article 6 establishes 3 distinct carbon market mechanisms, Article 6.2, Article 6.4 and Article 6.8 designed to facilitate international cooperation in achieving NDCs. These mechanisms enable the transfer of carbon credits between countries or entities through two modalities: internationally transferred mitigation outcomes (ITMOs) under Article 6.2, and emission reductions under Article 6.4, also known as the Paris Agreement Crediting Mechanism (PACM) and Article 6.8 promotes non-market-based cooperation.

On the Article 6 development, Oman launched a national article 6 carbon market framework, the policy emphasis on attracting international finance for technologically advances, high abatement cost mitigation projects. This is reflected in the positive list of pre-approved project activities in Oman and during COP28 in 2023, the UAE and Paraguay signed potential bilateral agreements related to Article 6 of the Paris Agreement. Morocco also seems more advanced stage of Article 6 implementation, expecting ITMO offtake agreement with Switzerland’s Klick Foundation and another one with Norway.

Looking ahead, 78% of NDCs indicate an intention to leverage Article 6 mechanisms, and the upcoming year will be pivotal for enhancing ambition. Coordinated international cooperation and tailored capacity-building efforts will be essential to address gaps, strengthen policy frameworks, and promote robust implementation. Article 6 mechanisms offer transformative opportunities to enhance climate ambition, mobilize financial resources, and facilitate technology transfer, making them a vital tool for advancing global climate goals and sustainable development.

Table 1: Carbon Market Initiatives in the MENA Countries

Outlook for the MENA Region

Carbon markets have gained unprecedented momentum across the MENA region, representing a significant shift towards low-carbon economic development. Nearly all Gulf Arab countries have launched carbon market-related initiatives, ranging from voluntary carbon credit exchange platforms to national carbon frameworks. Carbon markets present a major opportunity for MENA countries to advance sustainability and decarbonisation goals. As a fast-growing part of the region’s climate strategy, carbon credit adoption is accelerating, especially among corporate sustainability leaders and high-emitting sectors.

Governments across the region particularly in the UAE, Saudi Arabia, Oman and Egypt are actively developing carbon market exchanges and regulatory frameworks. The UAE stands out with its world-first financial markets regulation, reinforcing its role as a global carbon trading hub.

Establishing a regional block for carbon markets including Article 6 implementation would be key. This regional alignment could: create a cohesive regulatory framework aligned with international standards; foster partnerships with both developed and developing nations; enable the GCC to play a more significant role than during the Kyoto Protocol era; facilitate knowledge exchange and investment opportunities; support deployment of advanced monitoring technologies; promote capacity-building initiatives; and create awareness campaigns to engage local businesses and communities.

A well-functioning global carbon market has the potential to mobilize trillions in private sector finance, accelerate clean technology innovation, and enable large-scale emissions reductions. MENA countries are uniquely positioned to catalyse this transformation, driving sustainable development and economic diversification while cementing their role in global climate action.